Bank Achieves 70% Customer Resolution Within The IVR

By leveraging advanced IVR technology, banking has steadily evolved to become more automated, much faster, and more convenient for customers. Not long ago, most banking transactions were conducted in a brick-and-mortar branch. Today nearly every banking transaction can be performed online or over the phone.

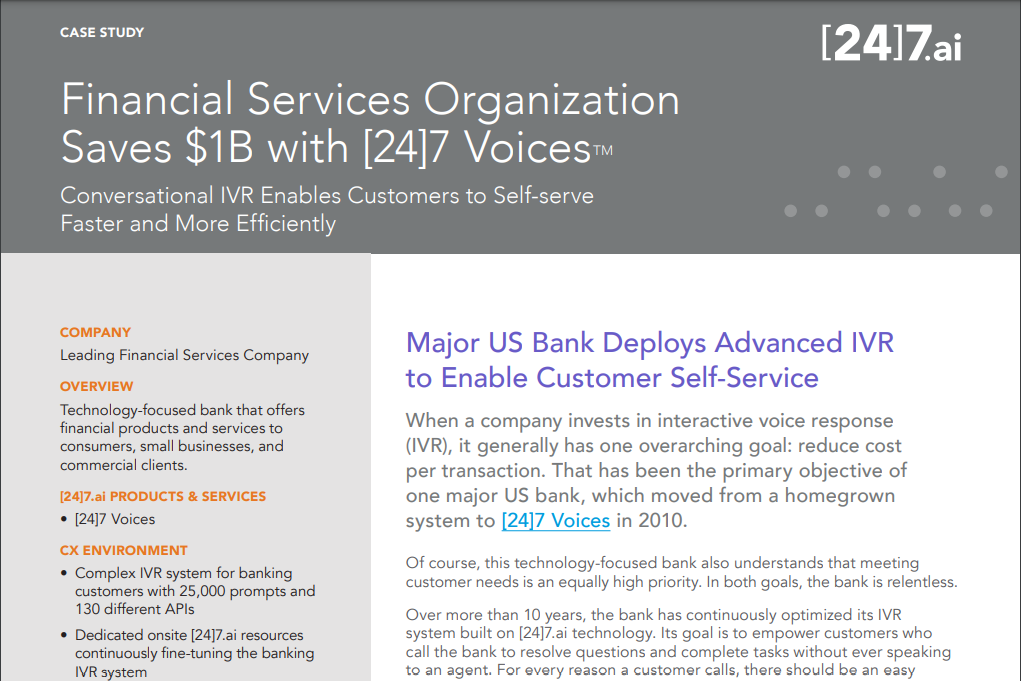

This evolution has led to a constant focus on efficiency and cost savings. This major US bank partnered with [24]7.ai to harness the power of technology to achieve business goals, solve problems, and save millions of dollars annually. For example, every time an agent picks up the phone to help a customer or answer a question that an IVR system could handle automatically, costs increase unnecessarily.

The bank calculates that for every 1 percent improvement in the rate at which calls are handled through the IVR without requiring an agent to assist—the company saves approximately $10 million per year.

By continually fine-tuning the system over the years in close partnership with [24]7.ai developers and data scientists, the bank and [24]7.ai steadily improved customer resolution by 27%.

That 27% improvement translates to a savings of more than $100 million per year on average. Over the past 10 years, the IVR solution has handled over one billion self-service interactions with 99.996 percent uptime. Increased use of phone self-service has saved the bank $980 million in net service costs.